There’s a quiet shift reshaping India’s manufacturing landscape.

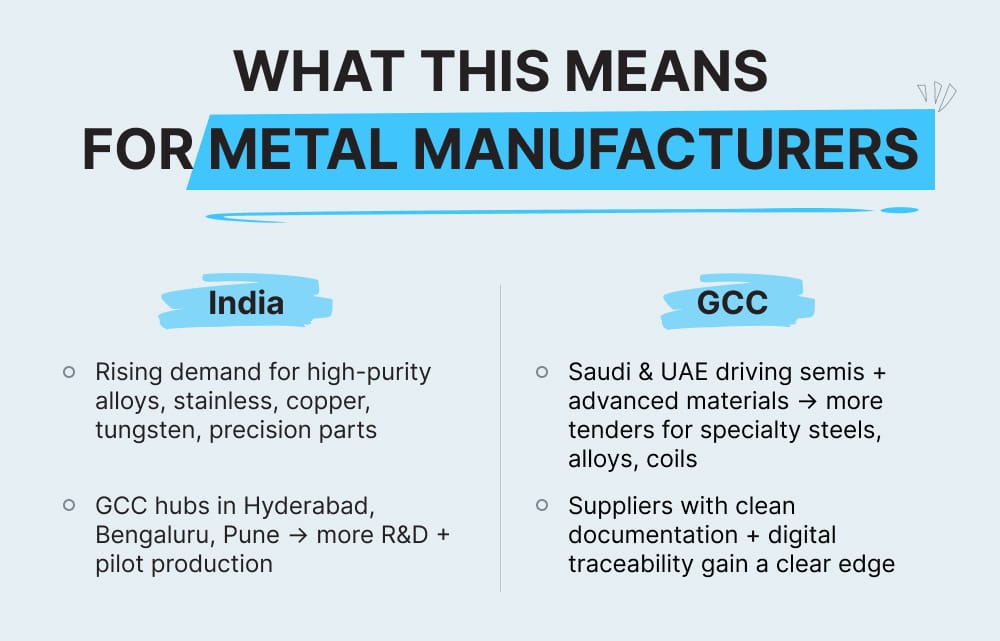

Global Capability Centres (GCCs), once focused on software and services, are now moving aggressively into semiconductors, advanced materials, and specialty metals.

According to multiple reports:

Hyderabad alone accounts for 46% of all new GCCs in India.

EU and US firms are using India as a base for co-innovation in silicon carbide (SiC) wafers, power electronics, and specialty alloys.

GCCs are expanding into R&D for high-performance materials, linking semiconductor innovation directly to metals demand.

Inductus and ET Edge reports show a sharp continental shift: GCCs are no longer support centres, they’re becoming core engineering and materials innovation hubs.

Every semiconductor breakthrough requires metals.

And SiC fabs, battery units, aerospace materials teams, and EV R&D centres all consume high-purity metals, precision components, and specialty alloys.

The semiconductor boom isn’t happening in isolation; it’s pulling metals up with it.

Manufacturers who align with GCC-driven R&D and specialty materials demand in 2026 will win new categories, new buyers, and more profitable orders.